BFSI: Decoding the Gilt-Edged Career Opportunity for Indian Talent

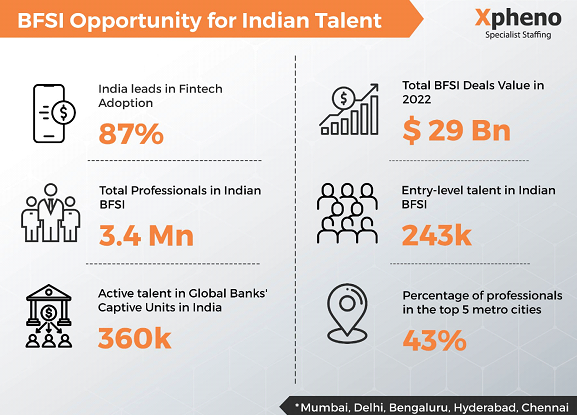

The Banking and Financial Services sector has witnessed tremendous talent growth over the last few years. BFSI currently engages around 3.5 million white-collar professionals in India. As per Xpheno’s research, the sector has the second-largest number of active jobs for freshers and entry-level talent, trailing just behind the IT Services and Software products sector.

So, what are the major pull factors/attractiveness of BFSI jobs? Let’s dissect the appeal of BFSI for Indian talent.

The Attractiveness of BFSI for Indian Talent

Anyone who chooses a career portfolio* (as opposed to a career path) can’t really ignore the Banking, Financial Services/ New-age Paytech/ Fintech world. Here are the major reasons why the sector holds immense appeal

While compensation has typically been one of the major pull factors for the talent opting for BFSI jobs, the innovation-driven BFSI space has become a thrilling opportunity for banking talent who have built fortunes even before they turn 40! It’s no wonder that almost 20% of the unicorn clubs are from BFSI alone.

For Freshers, Entry level and Mid-level professionals, the BFSI presents an additional three key attractions/pull factors namely, prestige and diverse career prospects, a valuable set of transferrable knowledge and skills, and high growth potential.

Prestige and career prospects

The financial services industry is viewed as a prestigious career lane in India. It is linked with a sense of high social status and respect within Indian households. Besides, the recent fintech innovations incorporated within BFSI have also increased the growth potential for young talent within the industry. The focus has shifted to skillsets, productivity, and efficiency, making BFSI an aspirational choice for millennials and GenZ.

Additionally, with the growing demand for skillsets in areas such as Big Data, Artificial Intelligence (AI), Machine Learning (ML), NLP, and Analytics within the BFSI industry, BFSI has opened its doors to young talent from diverse educational backgrounds. Students in commerce or finance streams, but also Humanities, Design, STEM, and Tech can find relevant roles within BFSI. The sector recognizes multidisciplinary talents to navigate the evolving landscape of financial services, hence it embraces individuals with expertise beyond traditional finance and accounting backgrounds.

A set of transferable knowledge and skills

In the BFSI sector, your expertise in Sales, Credit, Operations, Risk, Underwriting, Treasury Finance, Marketing Actuarial, and Analytics could be largely fungible. The soft skills and learnings developed in this sector (which include problem-solving, critical analysis, conflict resolution, etc) are easily transferable to other sectors and roles. For example, a Business Head in a bank for retail products can easily move into an insurance company or an NBFC or vice versa to a larger profile. Similarly, a risk professional can be suited across Banks/NBFC/Insurance/Venture Capital or the Mutual Fund AMC.

This provides the much-needed career flexibility that Gen Z and Millennials look for, while also providing opportunities for vertical and horizontal career growth.

High growth potential

As one of the fastest-growing Indian industries, it is no wonder that BFSI offers myriad opportunities for career growth to professionals. The sector encompasses Banks, Investment Banks, Asset Management Companies, Life and Non-life Insurance, NBFCs, HFCs, fund houses, Distribution, and Broking amongst others, and it holds immense potential for professionals to advance in their careers, explore international exposure (with many companies having a global presence and offering global projects), and enjoys inter alia, significant salary growth, including higher base salaries.

As explained earlier, BFSI also offers vertical and horizontal growth in myriad roles in sales, credit, operations, risk, finance, compliance, and marketing. Moving across different roles in BFSI is comparatively easier given the shared fungible skills required in various functions.

Along with high growth potential, higher compensation mentioned below is yet another major pull factor that attracts specialists and senior-level pros to BFSI.

Compensation

CTOs, Relationship managers, and VPs for Private Equity, Investment Banking, and VC global funds are some of the high-demand roles that offer sky-high salary packages. The Michael Page India Salary Guide 2023 also reveals that BFSI offers lucrative packages to professionals with long-term careers in BFSI.

To give you an idea of the salary ranges in the BFSI sector, let’s take a look at some figures from the Michael Page India Salary Guide 2023. Professionals with 15+ years of experience in the Global Fund for Private Equity and Venture Capital can expect an average salary of 250 LPA (Lakhs Per Annum), which can go up to an impressive maximum of 600 Lakhs for Managing Directors (with 20+ years of experience) in MNC banks and private banks. In the field of Corporate Finance/Mergers and Acquisitions (M&A), Investment Bankers at the director level have the potential to earn up to 200 LPA, while Managing Directors can earn around 400 Lakhs. Business Analysts at the Managing Director level can earn up to 120 Lakhs in the Banking and Financial services industry.

In comparison to high-paying roles in other industries like manufacturing or engineering, the salary numbers in the BFSI sector stand out. For example, a Chief Operations Officer with 15+ years of experience can expect an average salary of 155 LPA in the manufacturing industry. Similarly, the Head of R&D with a similar experience level (of 15+ years) typically earns around 63 LPA. When it comes to engineers in the Civil, Mechanical, or Electrical domain with 20+ years of experience, the average salary ranges around 80 LPA in the Manufacturing and Engineering industry. The BFSI sector offers higher compensation on average, making it an attractive choice for professionals seeking lucrative opportunities.

Hence, the BFSI sector is enticing for talent, now let’s conclude by examining the new/emerging sought-after skillsets in this sector/industry.

Skillsets in demand in BFSI

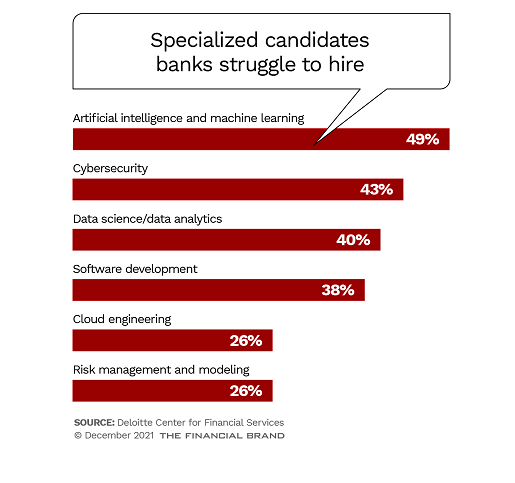

Banking has transformed significantly in the past few decades, with traditional methods rapidly evolving. The BFSI sector now places a greater emphasis on technology and digitalization, leading to a surge in demand for tech roles and the need for new skillsets. The infographic below, sourced from The Financial Brand, highlights the skillsets that banks worldwide find challenging to hire.

As per the BFSI Sector Skill Council of India, the Indian banking sector is witnessing the rapid emergence of verticals, such as Digital Banking, Cybersecurity, Artificial Intelligence, Robotics Process Automation (RPA), Data Analytics, Debt Resolution and Recovery, and Risk and Compliance. These verticals demand a diverse pool of talented professionals with specialized technical skills, generalist expertise, and business management acumen.

Xpheno’s research on BFSI talent in India reveals that the current demand for tech skills is across functions of core development, project management, operations, and customer success. While tech stack preferences have changed over the years, the functional skills demand patterns remain largely unchanged. There has been a significant increase in demand for Fullstack Engineers, Data Engineers/Data Analytics, Frontend Engineers, SRE/DevOps, Data Scientists, and Backend Engineers.

Further, sought-after specializations in Web3, Blockchain and Crypto domains include:

● Blockchain Specialist (SME-Developer, Architect)

● Machine Learning Specialist (SME-Engineer, Sr.Engineer, Lead, Architect)

● Security Engineer (Information, Network)

● RippleX – Developers/Engineers/Administrators

● Frontend Developers/Engineers (ReactJs, VueJS, TypeScript, Angular)

● Backend – Developers/Engineers (NodeJs, Python, Golang)

● Data Analysis (Analytics, Architect)

● UI/UX Design

● Web Developers/Designers

● Content Writers/Developers

● Financial Analyst (Technical, Functional)

The Bottomline

The BFSI sector in India has experienced significant growth and offers a multitude of opportunities for talented individuals in India. With a strong base for recovery and growth, enterprises need to develop effective human resource management and skill development initiatives that will play a crucial role in driving India’s digital finance revolution to the grassroots level.

The appeal of BFSI, as well as the Indian Fintech Unicorns, lies in their compensation, prestige, diverse career options, transferable skills, and high growth potential. In terms of skillsets, there is a rising demand for tech roles, including blockchain, AI, data analytics, and cybersecurity. Overall, BFSI presents a shining opportunity for Indian freshers as well as experienced talent to thrive and succeed. The sector empowers the Indian economy as well as the Indian professionals looking to carve out a unique career portfolio for themselves.

*A career portfolio is different from building a traditional career path, the old notion of following a linear progression in climbing the corporate ladder based solely on one’s core degree. Career portfolio encompasses a unique combination of skills, experiences, and talents that can be flexibly utilized in the future. It encompasses not only technical proficiencies but also a diverse range of soft skills and personal interests, such as creative writing or public speaking, negotiation skills etc which are vital for effectively navigating personal and professional obstacles.