How fintech payment startups power businesses in India

In the flourishing startup ecosystem in India, Fintech payment enterprises campaign to provide easier transactions and a better checkout experience for businesses. Some of these e-commerce platforms are a one-stop shop for webstore management with the convenience of one-click checkout for customers.

The service providers have come up with new built-in tools to save time and money for e-retailers with their e-commerce solutions that include management and processing of online payments. In this blog, we discuss the major players in the fintech payment ecosystem, and what they have in store for businesses in the post-pandemic world.

Let’s discuss:

- The rapid growth of fintech payment enterprises

- Valuation of fintech in India

- One-click payment startups

- Crypto disrupting the payment space

- The current competitive landscape of fintech payment startups:

The rapid growth of Fintech Payment Enterprises

According to the Economic Survey 2021-2022, India has become the third largest start-up ecosystem in the world. The expanding startup ecosystem and its growth in spending and tech adoption have helped payment infrastructure firms to grow in India. These companies require high-end tech infrastructure to organize their e-commerce activities and make them quick and accessible to the customers. Of the 42 fresh Indian unicorns of 2021, 33 use Razorpay, Mathur, co-founder of Razorpay claimed.

With the peculiar challenges brought by the pandemic, Fintech ecommerce solutions gained even more importance. Adoption of the online mode is now a necessity for retailers and corporations alike.

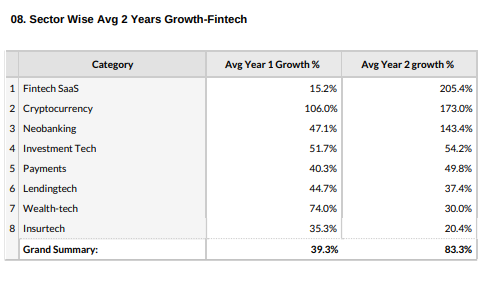

Xpheno’s research on 125 major Indian Fintech enterprises revealed that out of those 24 Unicorns and 101 Soonicorns, 93 have seen massive growth in 2021. Of these, 18 were in the payment sector and have seen 49.8% growth in the past 2 years.

Though the industry arrived in India 2 decades ago, it has fanned out rapidly in the past 5 years. Recently, the Fino payments bank, one of the firstcomer Fintech startups in India became the first profitable fintech business stepping into the stock exchanges. Others like Paytm and Mobikwik also made their debut in the stock market in 2021 to raise initial public offerings (IPOs), dilute foreign investment, and better relationships with Indian market regulators (SEBI)

Valuation

Indian fintech enterprises raised 10 billion USD in the global market in the past 5 years. With explosive growth, the Indian Fintech sector holds an estimated valuation of 50-60 billion USD. According to a BCG report, it is expected to reach 150-160 billion by 2025.

The Indian fintech ecosystem has benefitted from its excellent Indian tech talent, startup-friendly government policies, and access to Indian exchange listings. The companies are garnering the confidence of investors around their revenue model with growing internet penetration in the enormous Indian consumer market.

One-Click-Payment startups

One-click buying is one of the features many SaaS e-commerce platforms and fintech payment enterprises provide to enhance online merchandising.

Paytm, India’s largest payment company, provides the feature of one-click payment to consumers and comprehensive payment solutions to over 8 million merchants in India. Other leading Indian Fintech startups like Razorpay and Instamojo offer digital payment solutions for startups and MSMEs. The Magic pay tool by Razorpay is a feature that saves the transaction credentials for users so that the buyers don’t have to fill in the card details and location for shipping over and over again. It has made the checkout 50% faster and the conversions 20% greater for businesses, the company stated.

Platforms like Mswipe provide payment devices and software solutions for merchants. Financial software systems pvt ltd (FSS), one of the oldest fintech enterprises in India, offers other business management services such as systems integration, app communication, and data exchange through message-oriented middleware along with payment processing solutions.

Cashfree, PayU, and PayKun are other noteworthy brands enabling one-click payment that help merchants integrate various payment gateways. PayU provides seamless integration of transaction gateways like UPI, Visa, Mastercard, e-wallets, and net banking. Cashfree also offers other e-commerce products such as UPI autopay, Refunds suite, and marketplace settlements.

Recko is a Fintech company that uses AI to collect and manage data from payment portals, CRM systems, and banks associated with the enterprise to ensure transparency and authenticity in all digital transactions. Epay later, another fintech payment company provides instant credit at the point of sale to enable faster purchases.

The exploding market of fintech payment services is also aiding in expanding market horizons for businesses. As India digitizes, mobile cash has become the habit and preference for payments. Consequently, there is a great need for digital infrastructure for the under-served segments of the market.

Crypto disrupting the payment space

Decentralized currencies have been around for quite some time now. Crypto evangelists have been trying to introduce it into the mainstream payment ecosystem, which for now is dominated by cloud-based e-commerce platforms.

However, as the data protection concerns increase and the crypto ecosystem expands in India, businesses having crypto payment options on their online checkout doesn’t seem like a crazy idea.

According to our data, crypto startups have had an average growth rate of 173% for the past 2 years. Whrrl and Moopay are 2 of the fintech startups bringing crypto payment infrastructure for merchants. Whrrl offers trading of agri-commodities on defi platforms. Moopay introduces infrastructure for merchants to integrate crypto payments with a cross-chain swap.

The Current Competitive Landscape

Currently, payment companies are taking up new ways to thrive in the flourishing space.

Now, some of the biggest players like Paytm and Razorpay are branching out in the neo banking sector. Neobanking, another Fintech sector, includes companies like FYP money, Finin, and Open, which have established banking platforms for businesses and consumers. Neobanking, surpassing the payment sector, has seen 143.4% average growth in the past 2 years.

Razorpay’s feature, RazorpayX Tax Payment Suite is making tax disbursements easier and allowing transparent and seamless integration of finance and accounting teams with the business for tax payments. Finly, another platform for merchant expanse management allows fund disbursements and automated collection.

Soonicorns like Insta Mojo and Mobikwik, on the other hand, are offering SaaS products that have more than just payments to offer. They build and deploy fully functioning check-out experiences for online shoppers, letting them pay quickly and easily. Ezetap, a mobile point of sale solution enables to connect mobile devices with card readers through the headphone jack of the mobile.

Some fintech companies are also enabling payment through short-term credit loans. Zest money offers EMI on a buy now pay later policy to consumers. While MojoCapital, a feature of Instamojo, offers bite-sized short-term credit loans to merchants on a monthly basis.

A few enterprises are also targeting their fintech services to small vendors. Companies like Lendingkart and Capitalfloat offer loans to vendors and small enterprises. Pinelabs offers marketing tools and payment solutions for offline retailers. Khat book, another payment company offers business management for MSMEs

The growth curve of Fintech suggests that the fintech payment ecosystem has not reached its absolute potential yet. However, the competitive landscape also makes clear that companies that can deliver their technology products and services at the right time are the ones capable to unlock the potential of the marketplace.